per capita tax in pa

The Per Capita Tax Exemption Form should be used for areas not listed below. City Per Capita Taxes are based on a calendar year from January 1 thru December 31 of the current year.

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Per Capita Tax In Pa.

. Section 6-679 - Per capita taxes Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which shall levy such tax shall annually pay for the use of the school district in which he or she is a resident or inhabitant a per capita tax of not less than one dollar nor more than five dollars as may be assessed by the local school. The basic rate of income tax was 30 per cent 10 percentage points higher than where it is now while the standard rate of VAT was 15 five points lower than the current rate. Can I confirm the balance due for my tax bill.

3 any county which shall become a county of the third class may collect for a period of four years after such status has been certified a per capita tax from. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. A flat rate tax levied on each adult resident within the taxing district.

Motor and Alternative Fuel Taxes. The Salary You Need To Afford The Average Home In Your State Based On A 30 Year Mortgage With A 10 Map 30 Year Mortgage Usa Map Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an. The following shall apply.

Both taxes are due each year and are not duplications. Opry Mills Breakfast Restaurants. I moved and no longer live in this area.

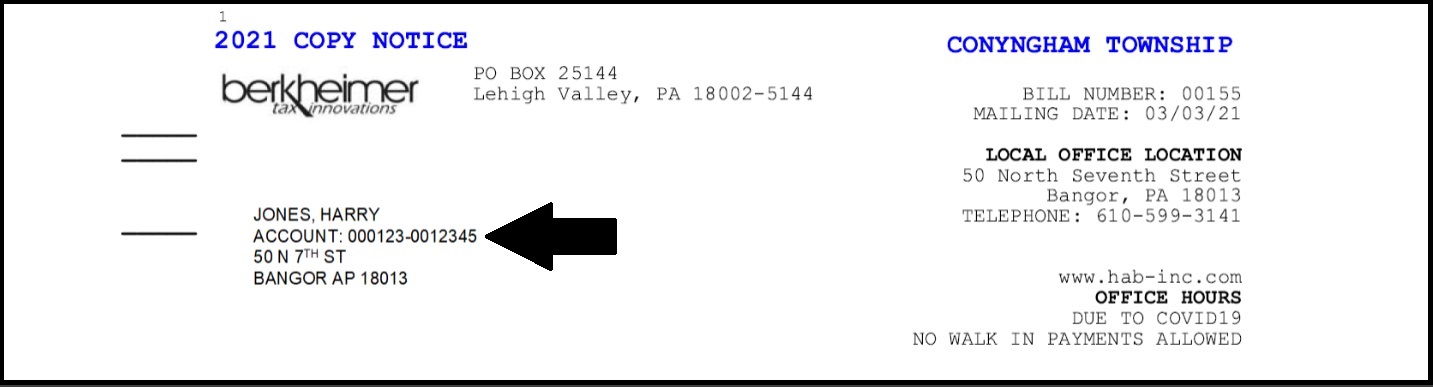

The tax is due if you are a resident for. Latest News From The City. If a payment is received without the tax bill form which was mailed to you we will need to prepare a duplicate bill.

The per capita tax is 10 per resident regardless of whether someone owns a home or not. If your area is listed below select the appropriate. If you pay your bill on or before the discount date in September you receive a 2 discount.

My billaccount information is incorrect eg addresslast name. A per capita tax for general revenue purposes at the rate of five dollars 500 per year is hereby levied on all inhabitants of the City about the age of twenty-one years. 1 Except as provided in paragraph 2 the authority of any independent school district to levy assess and collect any tax under the act of December 31 1965 PL1257 No511 known as The Local Tax Enabling Act shall expire at.

Normally the Per Capita tax is NOT. Donations For The Ukraine Thursday 07 April 2022 1048. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district.

Real Estate Transfer Tax. Seigworth mentioned the annual budget. Residence tax - See BUS.

Per Capita means by head so this tax is commonly called a head tax. A proportional tax levied on the. Can I have a copy sent to me.

Restaurants In Erie County Lawsuit. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Municipalities and school districts were given the right to collect a 1000 per capita tax under.

See reviews photos directions phone numbers and more for Washington Per Capita Tax locations in Ambridge PA. Per capita tax pennsylvania. Pennsylvania has a 999 percent corporate income tax rate and permits local gross receipts taxes.

Per capita tax in pa Friday April 1 2022 Edit. Reminder to pay your Per Capita tax bill before December 31st. Is this tax withheld by my employer.

As of 2019 the estimated average GDP per capita PPP of all of the countries of. You must file exemption application each year you receive a tax bill. The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County.

The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. What is the Per Capita Tax. Income Tax Rate Indonesia.

The school district as well as the township or borough in which you reside may levy a per capita tax. For most areas adult is defined as 18 years of age or older. Do I pay this tax if I rent.

Exoneration from tax is applicable to the current tax year only. Restaurants In Matthews Nc That Deliver. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Majestic Life Church Service Times. Pennsylvania has a flat 307 percent individual income tax. This article is a list of the countries of the world by gross domestic product at purchasing power parity per capita ie the purchasing power parity PPP value of all final goods and services produced within a country in a given year divided by the average or mid-year population for the same year.

Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber Borough delinquent Per Capita only and Shanksville-Stonycreek School District. A flat rate andor proportional tax levied on the occupation of persons residing within the taxing district. In other words if you live in an area.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. It is not dependent upon employment.

I lost my bill. 1000 annually per individual. I did not receive my per capita tax bill.

Per Capita Tax Reading Pa. Search any Ideas in this website. Are Dental Implants Tax Deductible In Ireland.

With an estimated population of 95112 as of the 2020 census it is the fourth most populated city in the state after Philadelphia Pittsburgh and Allentown. Passed 122771 33702 REPORT OF RENTAL UNIT OWNERS. If you pay after the Face Amount due date in November a 5 penalty is added to your taxes until the end of the year.

March 2 2022. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Annual new years eve fireworks celebration monday 27 december 2021 0940. Can I request a correction. Tax Types and Information.

Soldier For Life Fort. Pennsylvania has a 600 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state. Can you provide me with my invoice number so that I can make a payment online.

There are also jurisdictions that collect local income taxes. 331 33701 RATE ESTABLISHED. Sales Use and Hotel Occupancy Tax.

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Retirement Strategies

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization

A New Map Courtesy Tax Foundation Shows Where Pennsylvania Stacks Up On State Gas Taxes For More On Transpor Infographic Map Safest Places To Travel Fun Facts

Usa Salmonella Outbreak Cereal 2018 100 Family Income National Parks Credit Cards Debt

Per Capita Tax Exemption Form Keystone Collections Group

Real Estate And Per Capita Tax Wilson School District Berks County Pa

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Property Tax Definition Learn About Property Taxes Taxedu

Pin En Born In Blood Mafia Chronicles Cora Reilly

Information About Per Capita Taxes York Adams Tax Bureau

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Per Capita Tax Exemption Form Keystone Collections Group